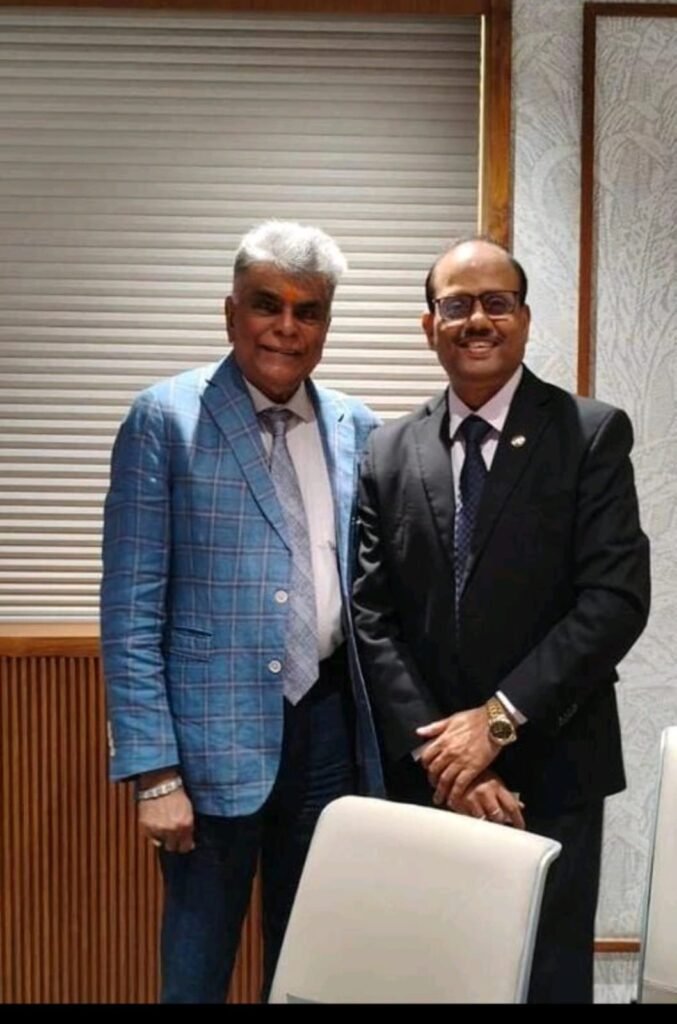

New Delhi, 16 February 2026:

Dr A. Sakthivel, Chairman of the Apparel Export Promotion Council (AEPC), met Shri Sanjay Malhotra, Governor of the Reserve Bank of India (RBI), in Mumbai today to advocate for a separate export policy tailored specifically for the MSME sector.

The meeting assumes particular significance at a time when India has signed Free Trade Agreements (FTAs) with 37 countries. With the next decade poised to offer substantial growth opportunities for India’s apparel and textile sector, Dr Sakthivel emphasised that the country must proactively leverage these trade advantages to strengthen exports. However, he underlined that structural reforms in export finance and banking regulations are essential to enable MSMEs to fully capitalise on these opportunities.

Call for a Dedicated MSME Export Policy

During the interaction, the Chairman of AEPC proposed the introduction of a dedicated Special Interest Package Scheme for MSMEs. At present, lending rates are determined by individual banks based on their internal policies and balance sheet positions. This has resulted in inconsistencies, higher borrowing costs, and limited predictability for MSME exporters.

In his representation, Dr Sakthivel stated:

“A large number of apparel exporters across India, predominantly MSMEs, face several operational and regulatory difficulties, particularly in their interactions with Authorised Dealer (AD) Banks, export finance systems, and compliance frameworks.”

He highlighted that MSMEs face multiple challenges, including:

- High interest rates on MSME loans are raising borrowing costs and reducing competitiveness.

- Lending rates are closely linked to CIBIL scores, placing small enterprises and first-time exporters at a disadvantage.

- High Turnaround Time (TAT) for loan processing and sanctioning, disrupting working capital cycles.

- Limited digitalisation in MSME lending processes results in procedural delays and a lack of transparency.

Proposal for Special Interest Package Scheme

Dr Sakthivel recommended that the RBI consider issuing regulatory guidelines to ensure fair, transparent, and uniform lending practices for MSMEs. He suggested implementing end-to-end digital loan processing systems with real-time tracking mechanisms to improve credit accessibility and operational efficiency.

A structured and standardised interest framework would not only enhance predictability for exporters but also contribute to sustainable sectoral growth, especially in the apparel segment, where working capital cycles are tightly linked to global buyer schedules.

Enhancing the Interest Equalisation Scheme

Addressing export finance constraints, the Chairman of AEPC urged that the existing Interest Equalisation Scheme (IES) be strengthened. Currently capped at 2.75%, he proposed increasing it to 5% for manufacturing exporters to offset rising financing costs.

He further requested the removal of the ₹50 lakh cap under the scheme and recommended enhancing the eligible limit in a graded manner based on turnover and export performance. Such measures, he noted, would significantly ease liquidity pressures on MSME exporters and improve their price competitiveness in international markets.

Structural Reforms to Strengthen MSMEs

In addition to interest-related concerns, Dr Sakthivel placed several structural reform suggestions before the RBI Governor:

- External Credit Ratings: To be made mandatory only for MSMEs with total banking exposure above ₹100 crores, reducing compliance burdens for smaller units.

- Credit Monitoring Systems: Credit Information Reports (CIRs) may be replaced with CRILC (Central Repository of Information on Large Credits) reports wherever applicable, ensuring more streamlined regulatory oversight.

- Processing Charges: Renewal charges for existing bank limits, where there is no enhancement or restructuring, may be waived or limited only to the enhanced portion, reducing unnecessary financial strain.

- Standardised Banking Charges: A uniform structure across banks for forex conversion and general service charges should be implemented, with RBI oversight to ensure transparency and fairness.

- Rationalisation of ECGC Coverage: Exporters already secure post-shipment risk coverage through active buyer policies from the Export Credit Guarantee Corporation of India (ECGC). However, banks separately obtain coverage for pre-shipment packing credit and pass on the premium cost to exporters. This dual coverage increases financing costs and compliance burdens.

- System Integration for Export Realisation: Seamless integration of foreign bank charges data from the RBI’s EDPMS system to the Customs ICEGATE system would help eliminate unnecessary short realisation notices from Customs authorities.

MSMEs: The Backbone of India’s Export Economy

Dr Sakthivel reiterated that MSME exporters play a pivotal role in India’s export growth and employment generation. Despite forming the backbone of the Indian economy, contributing nearly 30% to GDP, 45% to exports, and generating employment for over 11 crore people, MSMEs continue to face structural, financial, and procedural hurdles.

“Procedural delays, banking constraints, and regulatory complexities are affecting their operational efficiency and competitiveness,” he stated.

As India enters a new era of global trade partnerships, particularly with multiple FTAs in place, the apparel and textile sector stands at a strategic inflexion point. However, unlocking its full potential will depend on policy alignment, banking reforms, and targeted financial support mechanisms that recognise the unique realities of MSME exporters.

The meeting between Chairman AEPC and the RBI Governor marks a crucial step toward initiating policy dialogue aimed at strengthening export finance architecture and empowering MSMEs to compete effectively in the global marketplace.