The Apparel Export Promotion Council (AEPC) has underscored the resilience of India’s Ready-Made Garment (RMG) sector despite ongoing global economic volatility, tariff pressures, and shifting sourcing patterns.

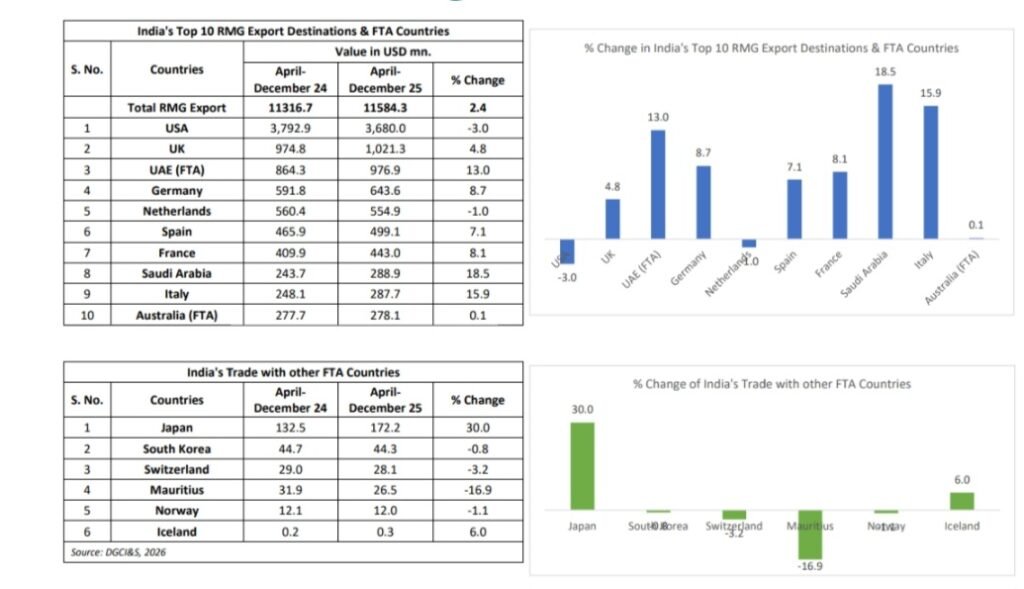

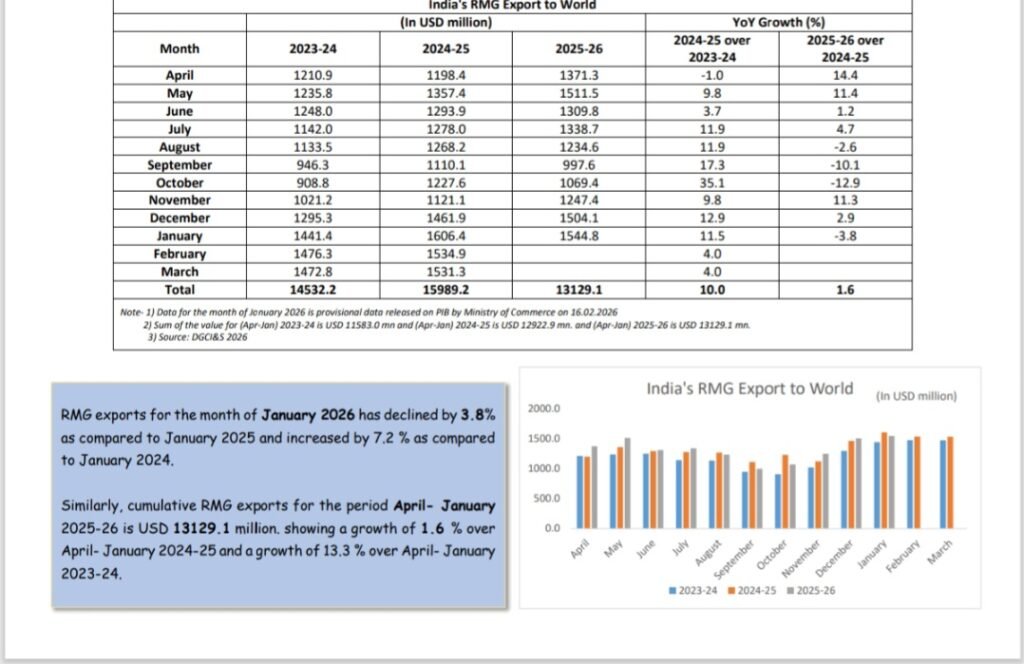

Commenting on the latest export trends, Dr A. Sakthivel, Chairman, AEPC, noted that while RMG exports in January 2026 recorded a decline of 3.8% compared to January 2025, they showed a robust growth of 7.2% over January 2024. The comparative figures indicate that despite short-term headwinds, the sector continues to demonstrate recovery momentum and structural strength.

Steady Growth in Cumulative Exports

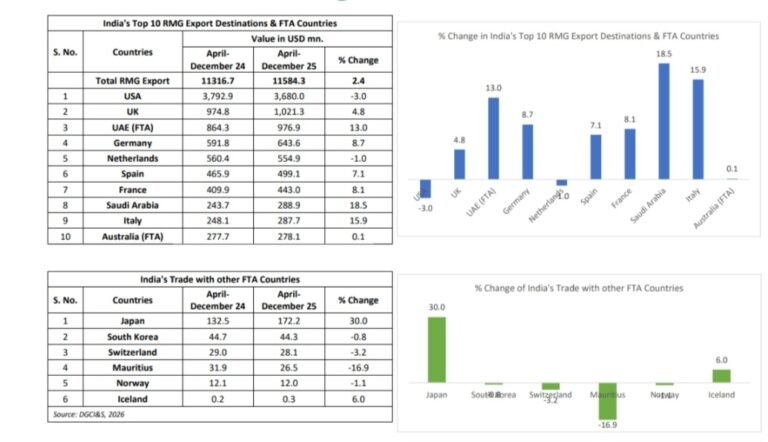

On a cumulative basis, India’s RMG exports during April–January 2025–26 reached USD 13,129.1 million. This represents a growth of 1.6% over the corresponding period of the previous year and a significant 13.3% increase compared to 2023–24.

These numbers reflect the apparel industry’s ability to navigate global uncertainties, including inflationary pressures, geopolitical tensions, and changing trade dynamics. The sector’s integrated value chain, diversified product portfolio, and skilled workforce have helped sustain export performance even during periods of demand fluctuation.

Impact of US Tariff Pressures

Dr Sakthivel explained that the January dip was largely driven by high tariff pressures in the United States, one of India’s key export markets, combined with broader global market uncertainty.

Exporters, in an effort to retain buyer relationships, absorbed rising costs by offering discounts of up to 20%. However, escalating tariff levels, approaching nearly 50%, severely eroded price competitiveness. As a result, a portion of orders was diverted to competing sourcing destinations offering more favourable trade terms.

The situation highlights the critical role of trade policy and cost competitiveness in sustaining export growth in a highly price-sensitive global market.

Leveraging India’s FTA Advantage

Despite current challenges, Dr Sakthivel emphasised that India’s Free Trade Agreements (FTAs) with 37 countries provide a significant strategic advantage. These agreements open doors for preferential market access, reduced tariffs, and expanded export opportunities.

India’s strong manufacturing base, vertically integrated textile ecosystem, and growing compliance standards position it favourably to capitalise on these agreements. With proper policy alignment and support mechanisms, the apparel sector can enhance its global presence across both emerging and developed markets.

MSMEs at the Core of Export Growth

A substantial share of India’s apparel exports is driven by Micro, Small and Medium Enterprises (MSMEs). However, these enterprises continue to face operational and regulatory constraints, particularly in areas such as banking procedures, export finance, compliance requirements, and digital integration.

Dr Sakthivel stressed that targeted policy support for MSMEs is essential to enhance competitiveness and sustain growth momentum. Procedural delays, limited access to affordable credit, and rising financial costs are impacting the working capital cycles of exporters.

Call for a Dedicated MSME Export Policy

During a recent meeting with the Governor of the Reserve Bank of India, Dr Sakthivel advocated the introduction of a dedicated export policy tailored to MSMEs. He proposed the creation of a Special Interest Package Scheme to ensure access to affordable and predictable finance for small exporters.

He further urged the enhancement of the Interest Equalisation Scheme from the existing 2.75% to 5% for manufacturing exporters. Additionally, he recommended removing the ₹50 lakh cap and introducing a graded eligibility structure based on turnover and export performance.

Such reforms, he noted, would significantly ease liquidity pressures, improve cost competitiveness, and strengthen India’s position in global apparel trade.

Outlook for the Indian Apparel Sector

“The Indian apparel industry remains fundamentally strong and adaptable. With appropriate policy support, particularly for MSMEs, and effective utilisation of trade agreements, the sector is well positioned for sustainable and inclusive growth,” Dr Sakthivel stated.

As global sourcing patterns evolve and buyers increasingly prioritise reliability, compliance, and diversified supply chains, India’s apparel sector has the opportunity to consolidate its standing as a preferred manufacturing destination.

While short-term fluctuations may continue due to global market volatility, the long-term trajectory of India’s RMG exports remains positive, provided financial reforms, trade leverage, and MSME-focused policy measures are implemented promptly.