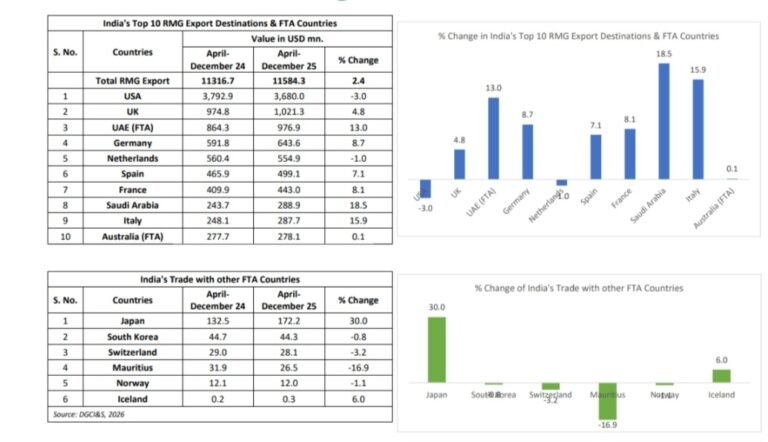

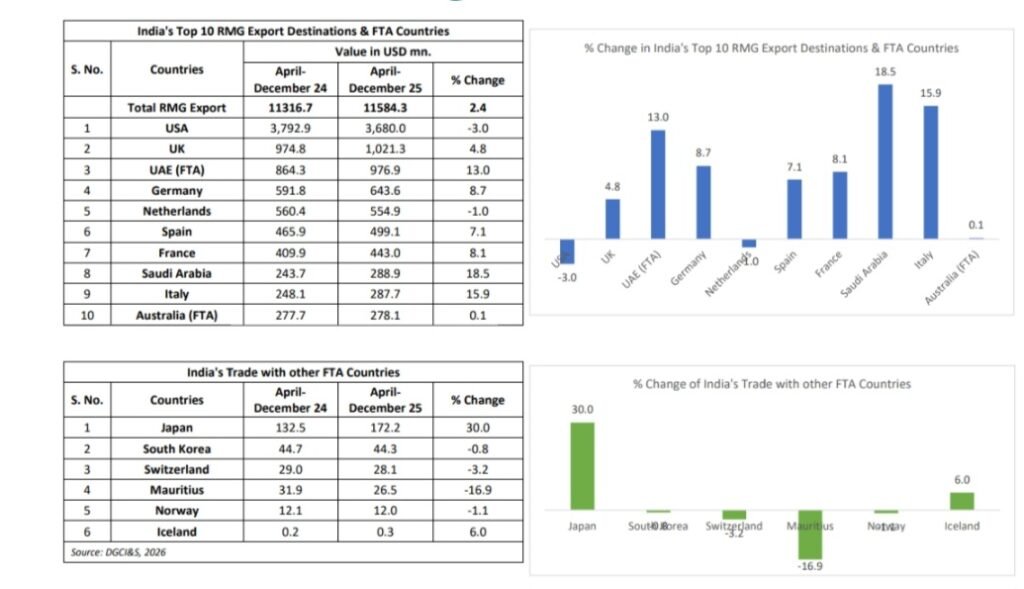

India’s apparel export industry is facing a critical moment as recent tariff actions by the United States threaten to destabilise one of the country’s most employment-intensive export sectors. With the US continuing to be India’s largest single destination for apparel exports, prolonged tariff uncertainty risks disrupting supply chains, eroding buyer confidence, and inflicting long-term damage on India’s global competitiveness.

This representation has been submitted to the Hon’ble Vice President of India, Thiru C. P. Radhakrishnan, seeking urgent intervention to protect India’s apparel export sector from the impact of recent US tariff actions

A Market Defined by Uncertainty

Dr A. Sakthivel, Chairman of the Apparel Export Promotion Council (AEPC), has formally appealed for urgent intervention, emphasising that timely resolution is essential not only to protect exports but also to safeguard millions of jobs dependent on the apparel and textile ecosystem.

The immediate concern stems from recent US measures imposing a 25 per cent tariff, along with an additional 25 per cent oil-related penalty on imports. Together, these actions have sharply increased landed costs for US buyers sourcing from India. The result has been widespread order hesitations, deferred commitments, and in some cases, outright cancellations. For an industry that operates on long production cycles and thin margins, even short-term disruptions can have cascading effects.

Why the US Market Matters Disproportionately

The sector’s exposure to the US market is particularly high. For several large Indian exporters, the US accounts for close to 70 per cent of total export volumes. This dependency is compounded by the structural realities of apparel manufacturing. Orders typically involve a work-in-progress cycle of around four months, while product development and order finalisation can stretch to six months. Wage costs alone account for roughly 30 per cent of total expenses and are largely fixed. These characteristics leave exporters with very limited capacity to absorb sudden and prolonged cost shocks.

In response to the initial tariff impact, Indian exporters have taken extraordinary measures to preserve buyer relationships and maintain production continuity. Many have absorbed price reductions equivalent to the oil-related penalty, effectively accepting a 25 per cent margin hit in anticipation of an early India–US tariff or trade resolution. While this approach has temporarily prevented order disruptions, it has come at a steep cost. Profit margins have been wiped out, internal reserves are being rapidly depleted, and the strategy is clearly unsustainable beyond the short term.

The risk environment has since intensified. With the possibility of additional tariffs or prolonged delays in resolution, US buyers have become increasingly cautious. New orders are being withheld, and buyers are unwilling to commit to production cycles that carry the risk of mid-course tariff escalation. Even with substantial discounts already offered, exporters have reached the limits of what they can absorb. Passing additional costs on to buyers is not commercially viable in a fiercely competitive global sourcing landscape.

Why Market Diversification Is Not a Short-Term Solution

Suggestions of rapid market diversification, while valid in the long term, offer little relief in the present crisis. Apparel sourcing relationships are deeply embedded within buyer supply chains and governed by rigorous compliance, audit, and onboarding processes. Developing alternative markets typically requires two to three years to achieve meaningful scale. Any abrupt erosion of the US market would therefore result in permanent customer displacement, allowing competitor nations with preferential trade access to replace Indian suppliers.

The consequences of inaction are severe and immediate. In the short term, exporters face production cuts, factory shutdowns, and large-scale job losses across apparel clusters. Over the medium term, declining export earnings and tax revenues would weaken the broader textile value chain. In the long run, India risks an irreversible loss of market share in the US, undermining decades of progress in building a reliable and competitive export ecosystem.

The Case for Immediate Policy Intervention

To prevent such outcomes, the industry has urged decisive action. An immediate conclusion of an India–US tariff treaty would provide much-needed certainty. Alternatively, an interim tariff relief or suspension mechanism until treaty finalisation would help stabilise the sector. Even temporary relief would restore buyer confidence, protect ongoing work-in-progress, and prevent irreversible damage to export commitments.

The appeal to policymakers is clear and urgent. The Indian textile and apparel industry has already absorbed significant financial losses in the national interest to protect exports and employment. There is no remaining capacity to withstand further shocks. A delay of even three to six months could permanently weaken a strategic sector that supports millions of livelihoods and plays a vital role in India’s export economy.

Swift intervention now can preserve not only export volumes, but also India’s credibility, continuity, and long-term positioning within global apparel supply chains.

The industry respectfully requests the Hon’ble Vice President of India, Thiru C. P. Radhakrishnan, to kindly refer this appeal to the Government of India for immediate and necessary action.