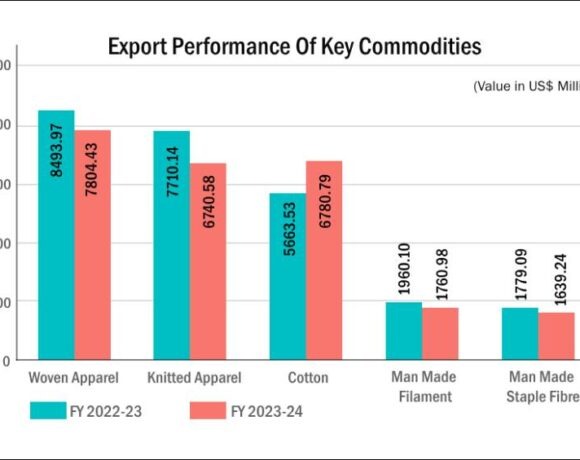

India’s textile and apparel industry has recorded remarkable growth, with October 2024 marking a significant milestone. Textile exports surged to $1,833.95 million, reflecting an 11.56% year-on-year increase, while apparel exports climbed by an impressive 35.06%, reaching $1,227.44 million. Combined, textile and apparel exports for October 2024 showed a robust 19.93% growth compared to October 2023, underscoring the industry’s strong performance.

From April to October 2024, India achieved a 4.01% increase in textile exports and an 11.60% rise in clothing exports compared to the same period the previous year. These figures affirm India’s growing prominence as a key player in the global textile market. According to projections from Invest India, the nation’s total textile exports are expected to reach $65 billion by FY26, further solidifying its global position.

A Promising Future for Domestic and Export Markets

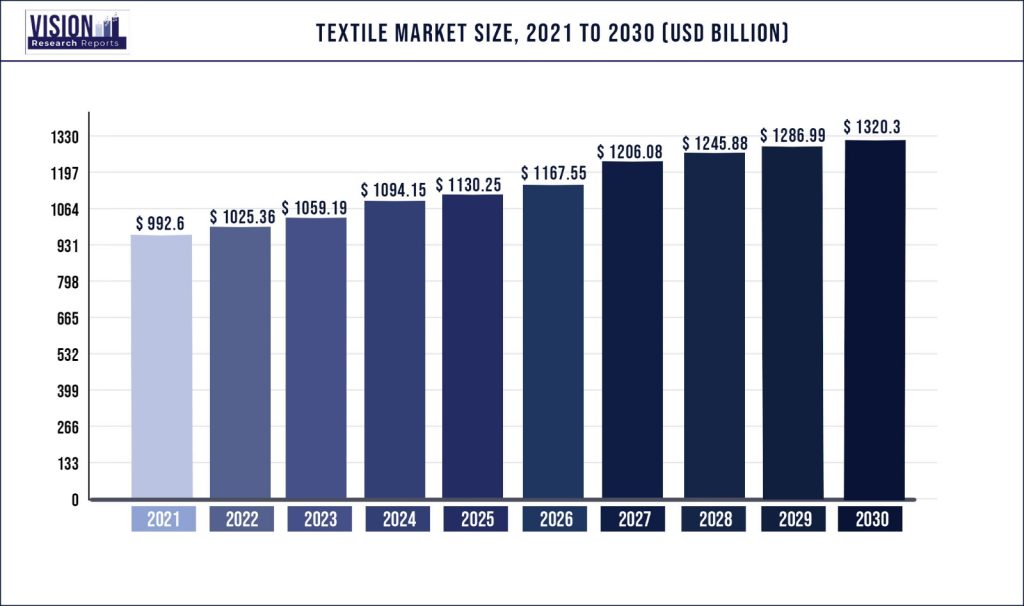

India’s domestic textile market, valued at $165 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of 10%, reaching $350 billion by 2030. This growth is fueled by $125 billion in domestic sales and $40 billion in exports, with the export share expected to rise significantly in the coming years

Key Drivers of Growth

Several factors contribute to India’s ascent in the textile and apparel sector:

Political Stability and Market Diversification India’s political stability has attracted international buyers seeking a reliable sourcing destination. This stability offers a stark contrast to challenges faced in traditional markets like China and Bangladesh.

Declining Shares of Competitors China’s share of global textile exports has declined significantly due to increasing labor costs and geopolitical tensions. Similarly, political instability in Bangladesh has created opportunities for India to capture a larger market share.

Vertical Integration and Abundant Raw Materials India’s capability to produce a wide array of raw materials, including cotton, silk, jute, and synthetic fibers, gives it a competitive edge. Vertical integration—from raw material production to finished goods—reduces supply chain risks and ensures cost efficiency for buyers.

Global Brands Diversifying Supply Chains As global brands seek to mitigate risks by diversifying their supply chains, India has emerged as a dependable partner. Its ability to deliver high-quality products consistently makes it a preferred sourcing destination.

India’s Strategic Position

India’s strategic advantages extend beyond its production capabilities. The country’s skilled workforce, cutting-edge manufacturing technologies, and focus on sustainability have further bolstered its appeal to international buyers. Initiatives like eco-friendly production methods, renewable energy adoption, and compliance with global labor standards have enhanced India’s reputation as an ethical and sustainable sourcing hub.

India’s ability to handle end-to-end production processes—from fiber to fabric to fashion—makes it uniquely positioned to meet the complex demands of global markets. This comprehensive capability is particularly attractive to buyers looking to streamline their operations while ensuring quality and reliability.

Success Stories from India’s Textile Sector

Several Indian MSMEs and large exporters have capitalized on these opportunities:

- Textiles: Tamil Nadu-based firms have become leading suppliers of organic cotton products to European markets.

- Auto Components in Textiles: Surat-based manufacturers have seen significant growth in producing technical textiles for automobile interiors, with exports to Germany and Japan.

- Spices with Textile Packaging: Kerala exporters now integrate eco-friendly textile packaging for global spice exports, enhancing brand appeal.

These examples highlight India’s adaptability and innovation in meeting global market demands.

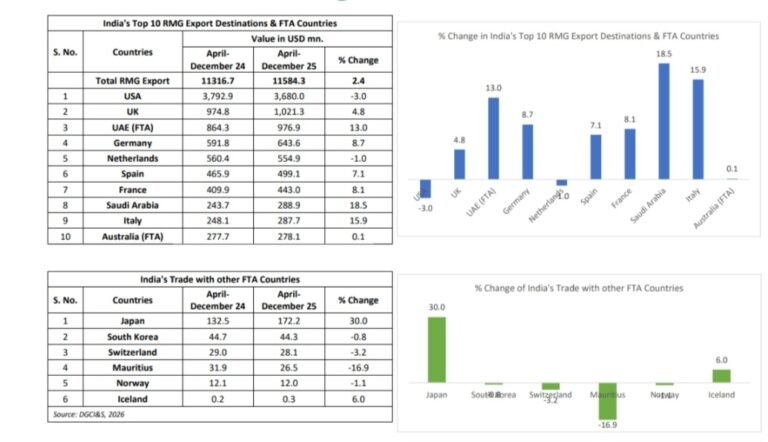

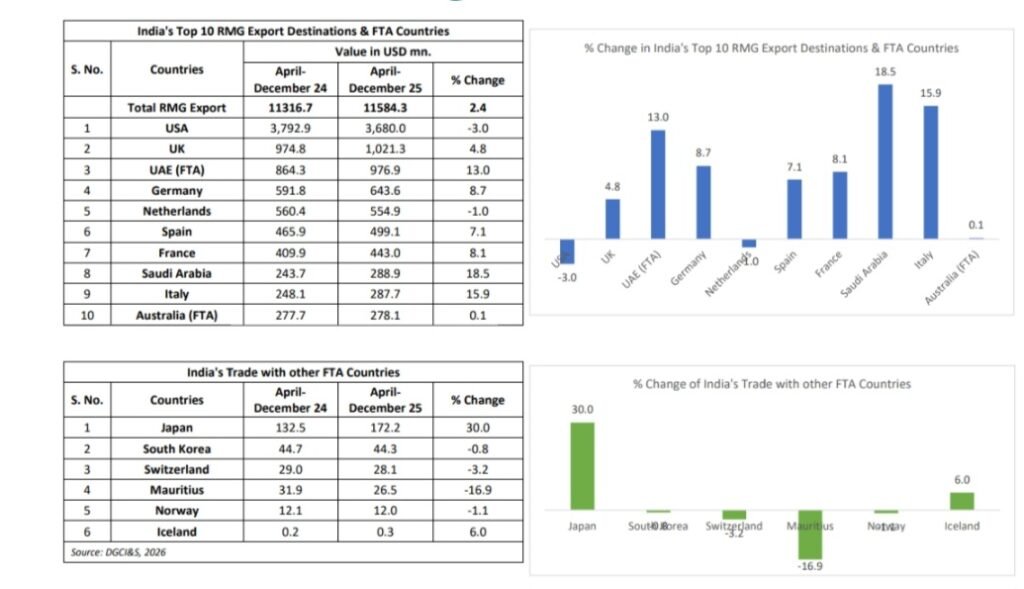

Export Contributions and Trade Agreements

India is one of the largest contributors to global textile exports. According to the Ministry of Commerce, India contributed 7% to global textile exports in 2023. Recent trade agreements, including those with Australia (under the Economic Cooperation and Trade Agreement) and Japan, have opened new avenues for market access and reduced tariffs, benefiting exporters.

Furthermore, the Districts as Export Hubs Initiative has facilitated localized export growth by empowering small-scale manufacturers in textile hubs like Tiruppur and Coimbatore. These initiatives are instrumental in sustaining the upward trajectory of India’s textile and apparel industry.

Challenges on the Road Ahead

While India’s growth story is impressive, the industry faces significant challenges:

- Meeting International Standards: Many small and medium enterprises (SMEs) struggle to comply with stringent quality and labor standards required by global buyers.

- Technology Adoption: Limited access to advanced machinery and automation hampers productivity and innovation.

- Logistics Costs: High transportation costs and inadequate infrastructure remain bottlenecks for scaling exports.

- Skilled Workforce Shortage: Despite a large labor force, skill gaps in technical and managerial roles affect efficiency.

Addressing these challenges will be crucial for India to sustain its growth momentum and fully capitalize on emerging opportunities.

Conclusion

India’s textile and apparel industry stands at a pivotal moment. With impressive export growth and inherent strengths like vertical integration, skilled labor, and sustainability initiatives, India is well-positioned to become a global leader. The sector’s ability to adapt, innovate, and overcome challenges will determine whether the projected $65 billion export target for FY26 becomes a reality.

India’s growing stature as a reliable, ethical, and strategic sourcing partner makes it an indispensable player in the evolving global textile landscape. As global markets diversify their supply chains, India has a unique opportunity to redefine its role and lead with excellence.